COVID-19 Stimulus Scams

Congress has recently passed a large COVID-19 relief and stimulus package. As with other aspects of the COVID-19 pandemic, fraudsters are exploiting the relief and stimulus to victimize the public. The U.S. Secret Service is observing a rise in stimulus relief fraud over the past several days and expect the fraud attempts to continue throughout the pandemic.

Criminal actors are using a variety of means to contact potential victims. In one instance, the criminal actors are using spoofed email addresses posing as U.S. Treasury officials requesting that the victim provide personal identifying information (PII), so that they can receive their share of the stimulus. A redacted example of an attack email is below:

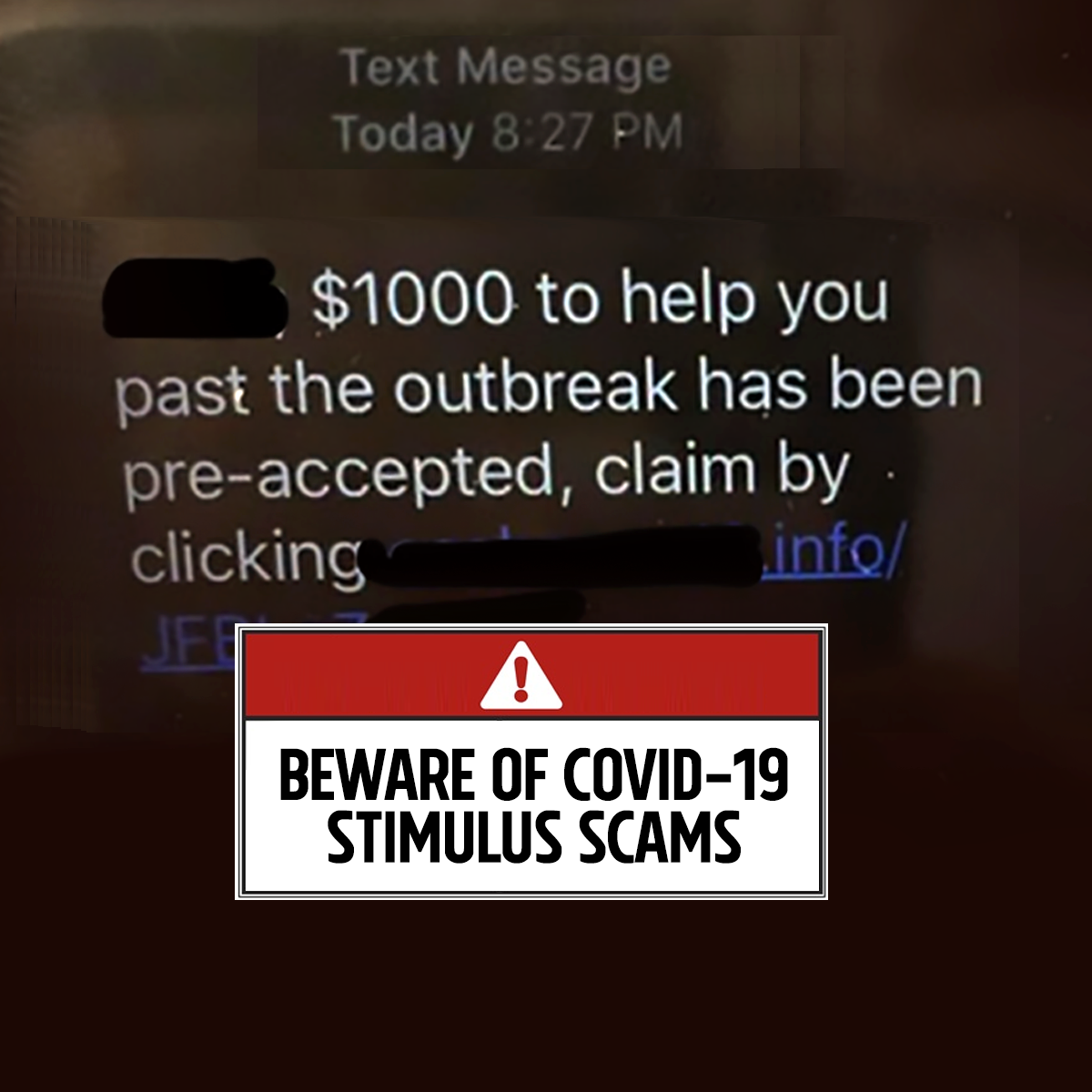

Other than via email, criminal actors are contacting potential victims via SMS/text, robocalls, and other messaging platforms. Through texts, criminal actors are sending links which directs individuals to a website, which then prompts the potential victim to enter PII and other sensitive information, such as bank account numbers, email addresses, and passwords. See below for an example of an attack SMS sent to a potential victim.

The attack above contained the victim’s real name, giving the text an appearance of legitimacy. Official stimulus/relief information regarding COVID-19 will never be sent via text/SMS or on any other messaging platforms.

Foreign partners are also seeing an uptick in COVID-19 stimulus relief fraud. The U.S. Secret Service anticipates instances of similar fraud affecting U.S. citizens in the coming weeks. The method is the same- a potential victim will receive a text message directing them to a link. Once they reach the link, they are prompted to enter a variety of PII data. See below for another example of these SMS/Smishing attacks received by our foreign partners.

The U.S. Secret Service stresses that individuals seeking information about the stimulus/relief program to contact the specific government agency via its website for guidance. Individuals should follow protocols published by those government websites. During this time, it is stressed that the public maintain an increased vigilance when providing any PII or other privileged and protected information.

The U.S. Secret Service is working with domestic and foreign law enforcement partners, along with the private sector, to disrupt and dismantle COVID-19 related fraud schemes. If anyone has any information related to this alert, the GIOC can be contacted at GIOC@usss.dhs.gov.

Click here to read the original PDF.

###